Stilt says that there are 150k+ users on the platform who are eligible for access checking accounts and remittance right from the Stilt app.

Stilt, a leading neobank for immigrants, has launched a new feature called “Instant Remit” that allows Stilt loan users to remit their loans immediately. After a loan is approved, Stilt users can choose to send it to their account or family back home without leaving the Stilt app.

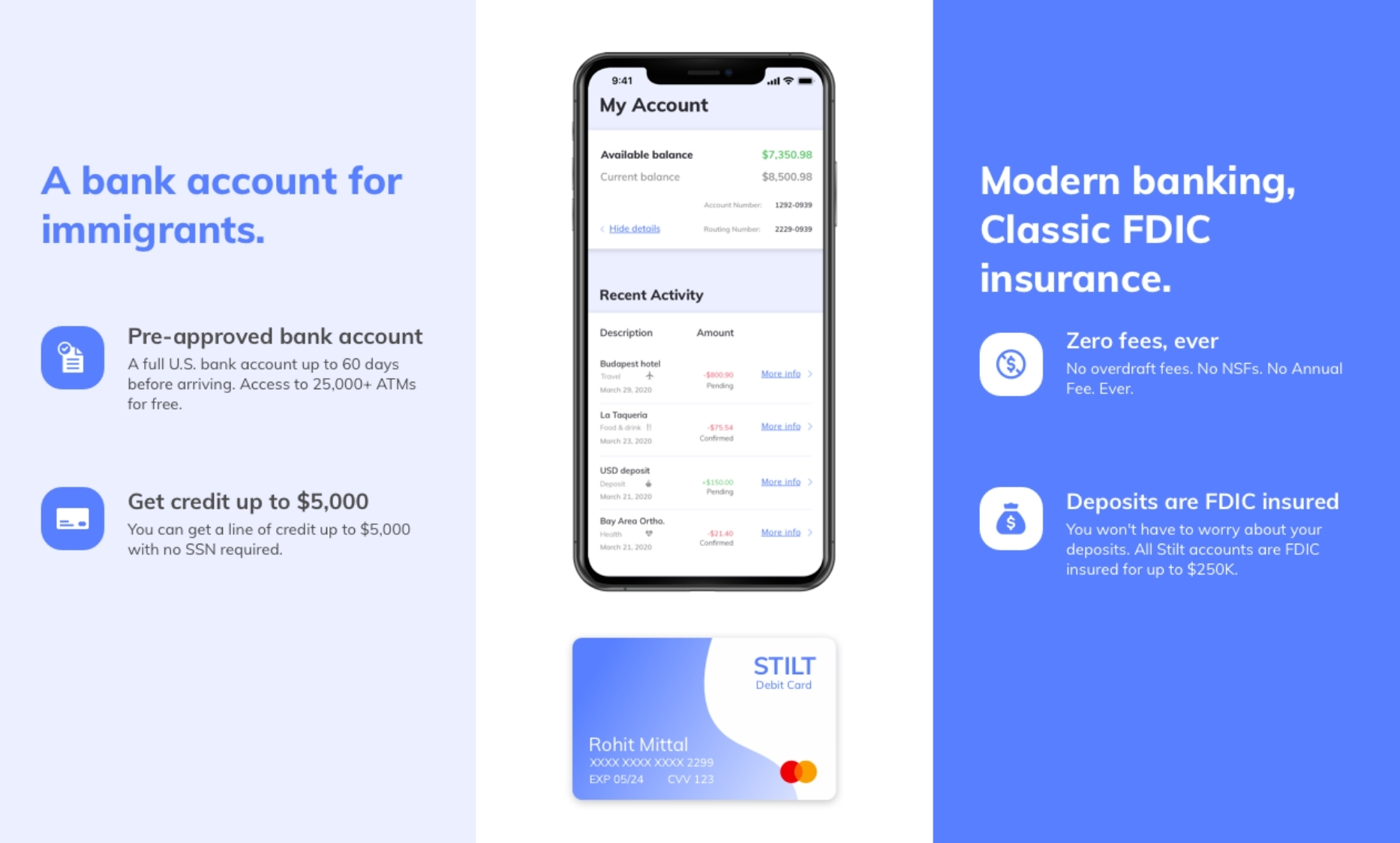

The “Instant Remit” feature is available for all Stilt checking account holders. It takes 5 mins to open a checking account and users get a free debit card. Stilt checking accounts can be accessed from the web and mobile apps. The feature is available in all 50 states in the US.

Stilt users can transfer up to $30k at once, which is the highest amongst all other providers. Stilt worked on unique KYC requirements with its partners to allow instant verification to unlock a higher transfer limit.

Previously, immigrants had to take a loan and transfer it to their checking account through ACH, a process that takes 2-3 days. Then users will have to use an expensive remittance service to transfer the funds. Adding another 3 days. With Stilt the transfer initiates instantly after the loan is disbursed.

The company’s mission is to democratize access to quality and affordable financial services for 45 million immigrants in the US. With this launch, Stilt is taking one more step towards building a financial hub for immigrants.

Stilt says that there are 150k+ users on the platform who are eligible for access checking accounts and remittance right from the Stilt app.

“With Stilt Instant Remit I was able to send $5,000 within a few hours to my parents in India for an emergency. I got the best exchange rates compared to the banks and other services. So happy that Stilt was able to help me at the right time.” says Karthik, a Stilt user from Texas.

Rohit Mittal, Cofounder and CEO of Stilt said – “We are excited to launch the ‘Instant Remit’ feature which helps thousands of our customers to instantly transfer their loan to their home country. We have seen this feature have helped many of our customers to pay off their student loans, send money for medical emergencies, weddings, and general support. We can’t wait for millions of immigrants to use it.”

Stilt also plans to launch additional products that will improve financial inclusion and make products more affordable for the general population.

Stilt is funded by Y Combinator and has raised over $240M so far including debt and equity. Stilt checking accounts are provided by Evolve Bank and Trust, Member FDIC.